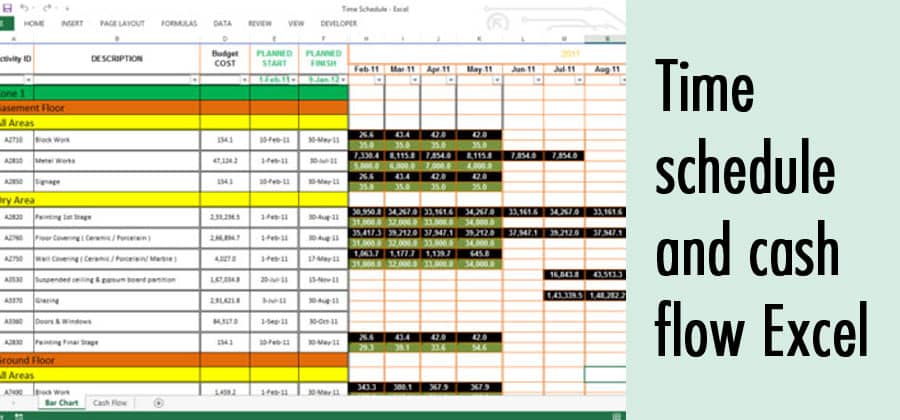

Time Schedule and Cash Flow Excel Sheet

Introduction

In today's fast-paced world, effective management of time and finances is crucial for the success of any project or business. Time schedule and cash flow are two vital aspects that require careful planning and monitoring. Fortunately, Microsoft Excel provides a powerful tool to handle these challenges.

Understanding Time Schedule and Cash Flow

Before diving into the details of using Excel, let's understand the importance of time schedule and cash flow in project management and financial planning.

Importance of Time Schedule

A time schedule outlines the tasks, activities, and milestones required to complete a project. It helps in organizing work, allocating resources, and ensuring timely delivery. A well-defined time schedule provides clarity, improves coordination among team members, and enables effective project monitoring and control.

Importance of Cash Flow

Cash flow refers to the movement of money in and out of a business or project. It is crucial for maintaining financial stability and ensuring smooth operations. Effective cash flow management allows businesses to meet their financial obligations, make informed decisions, and plan for future investments. It helps identify potential cash shortages and take proactive measures to mitigate risks.

The Role of Excel in Managing Time Schedule and Cash Flow

Excel is a versatile spreadsheet software that offers powerful functionalities for managing time schedule and cash flow. It provides a structured environment to organize data, perform calculations, and create visual representations. With Excel, you can create customized templates, automate calculations, and generate insightful reports, making it an ideal tool for time schedule and cash flow management.

Creating a Time Schedule Excel Sheet

To create a time schedule Excel sheet, follow these steps:

Setting up Columns and Rows

Begin by opening a new Excel sheet and setting up the necessary columns and rows. Typically, you would have columns for tasks, start date, end date, duration, assigned resources, and dependencies. Additional columns can be added based on your specific requirements.

Entering Tasks and Deadlines

Enter the tasks or activities in the appropriate column and assign start and end dates to each task. Clearly define the deadlines and milestones to ensure a realistic time frame for completion.

Assigning Resources and Dependencies

Assign resources to each task and identify any dependencies between tasks. This helps in understanding the critical path and managing interdependencies effectively. Excel's conditional formatting can be used to highlight critical tasks and visualize the project timeline.

Managing Cash Flow with an Excel Sheet

To manage cash flow using an Excel sheet, consider the following steps:

Tracking Income and Expenses

Create separate columns to track income and expenses. Record all incoming and outgoing cash flows accurately, including invoices, payments, salaries, bills, and other financial transactions. Categorize the entries to gain a better understanding of the sources and uses of funds.

Forecasting Cash Flow

Utilize Excel's formulas and functions to forecast future cash flows based on historical data and expected income and expenses. This helps in identifying periods of surplus or deficit and allows for better financial planning.

Analyzing Cash Flow Patterns

Excel provides various charting and graphing options to visualize cash flow patterns over time. Analyze the data to identify trends, seasonality, and areas of concern. This enables proactive decision-making and risk mitigation.

Tips for Effective Time Schedule and Cash Flow Management

Consider the following tips to ensure effective management of time schedule and cash flow using Excel:

Regular Updates and Revisions

Frequently update the time schedule and cash flow Excel sheet to reflect the latest information. This ensures accuracy and helps in making informed decisions based on real-time data.

Monitoring and Controlling Variations

Monitor the progress of tasks and compare it against the planned schedule. Identify any variations or delays and take corrective actions promptly. Excel's conditional formatting can be used to highlight deviations from the original plan.

Collaborating and Sharing the Sheet

Excel allows for easy collaboration and sharing of sheets with team members or stakeholders. Leverage this feature to foster transparency, encourage collaboration, and ensure everyone is on the same page.

Benefits of Using an Excel Sheet for Time Schedule and Cash Flow Management

Using an Excel sheet for time schedule and cash flow management offers several benefits:

- Flexibility: Excel allows customization and tailoring of the sheet to fit specific project requirements or business needs.

- Accessibility: Excel is widely used and accessible, ensuring compatibility and ease of sharing among team members.

- Data Analysis: Excel provides powerful data analysis tools, enabling insights into project progress, financial trends, and performance indicators.

- Cost-Effective: Excel is a cost-effective solution compared to specialized project management or accounting software.

Conclusion

Efficient management of time schedule and cash flow is essential for project success and financial stability. Excel provides a versatile and user-friendly platform to handle these tasks effectively. By leveraging the features of Excel, such as creating time schedules, tracking cash flow, and generating insightful reports, businesses and individuals can streamline their operations and make informed decisions.

FAQs

Can I use other software instead of Excel for time schedule and cash flow management?

While there are alternative software options available for time schedule and cash flow management, Excel remains a popular choice due to its versatility, accessibility, and cost-effectiveness. However, you can explore specialized project management or accounting software based on your specific needs.

How often should I update my time schedule and cash flow Excel sheet?

It is recommended to update your time schedule and cash flow Excel sheet regularly, especially when there are changes in project scope, timelines, or financial transactions. Aim for real-time updates to ensure accurate data for decision-making.