Risk Management Plan Excel Template: Streamlining Risk Assessment and Mitigation

Introduction

Efficient risk management is crucial for organizations to identify, assess, and mitigate potential risks that could impact their projects or operations. An effective way to streamline this process is by using a Risk Management Plan Excel template.

Benefits of Using a Risk Management Plan Excel Template

A Risk Management Plan Excel template offers several advantages, including:

- Structured Approach: Templates provide a pre-defined structure and framework for organizing and documenting risks, ensuring consistency across projects and facilitating easier analysis.

- Efficiency and Accuracy: The use of an Excel template allows for efficient data entry, analysis, and reporting. It eliminates the need for manual calculations, reducing errors and saving time.

- Customizability: Templates can be customized to align with specific project requirements or industry standards. You can adapt the template to suit your organization's unique risk management processes and terminology.

- Data Visualization: Excel's charting and graphing capabilities enable the creation of visual representations of risks, such as risk matrices and trend analysis charts, enhancing the understanding and communication of risks.

Key Components of a Risk Management Plan

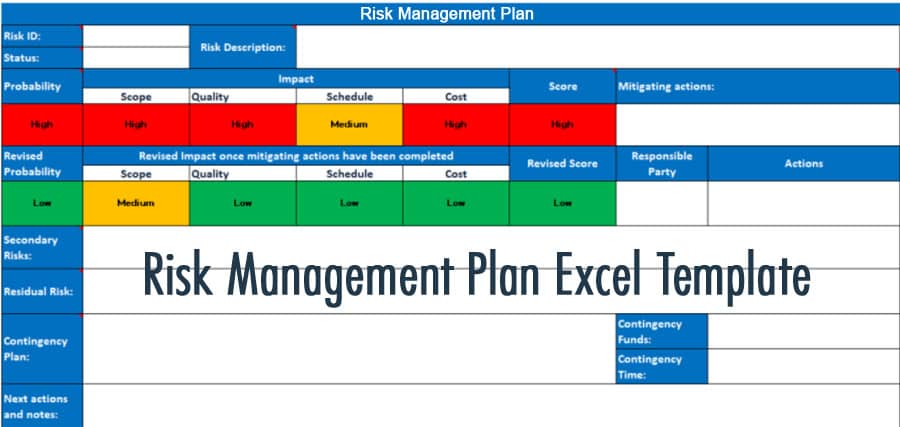

When utilizing a Risk Management Plan Excel template, it is essential to include the following components:

- Risk Identification: Identify potential risks associated with the project or operation. Categorize risks based on their nature (e.g., technical, financial, operational) and describe them concisely.

- Risk Assessment: Assess the likelihood and impact of each identified risk. Assign a risk rating or score to prioritize risks based on their severity and potential consequences.

- Risk Response: Define appropriate responses for each risk. This can include risk mitigation strategies, contingency plans, transfer of risk through insurance, or acceptance of certain risks.

- Risk Action Plan: Create a detailed action plan for implementing the identified risk responses. Specify responsible individuals, timelines, and necessary resources for each action.

- Risk Monitoring: Regularly monitor identified risks and their corresponding action plans. Update the risk status, track progress, and make adjustments as needed. Incorporate mechanisms for reporting and escalation of significant risks.

- Documentation and Reporting: Maintain a comprehensive record of all risk management activities, including risk registers, assessments, response plans, and monitoring logs. Generate reports summarizing the overall risk status and progress.

Conclusion

Using a Risk Management Plan Excel template can significantly streamline the risk management process for organizations. The benefits of a structured and customizable template include increased efficiency, accuracy, and data visualization. By including key components such as risk identification, assessment, response, action plans, monitoring, and documentation, organizations can effectively manage risks and mitigate potential negative impacts on their projects or operations.

FAQs

Where can I find a Risk Management Plan Excel template?

Risk Management Plan Excel templates can be found online through various resources, including project management websites, professional organizations, or software providers. Conduct a search using keywords like "Risk Management Plan template Excel" to find suitable options.

Can I modify a Risk Management Plan Excel template to fit my organization's needs?

Yes, Risk Management Plan Excel templates are highly customizable. You can modify the template to align with your organization's specific risk management processes, terminology, and reporting requirements.

Are there any pre-built formulas or functions in a Risk Management Plan Excel template?

Some Risk Management Plan Excel templates may include pre-built formulas or functions for automated calculations or data analysis. These can be beneficial for risk scoring, probability calculations, or generating visual representations of risks.